FAQs About Brokered Deposits

What is a brokered deposit and who is a deposit broker?

The term "brokered deposit" means any deposit that is obtained from or through the mediation or assistance of a deposit broker.

The term "deposit broker" refers to any person engaged in the business of placing deposits or facilitating the placement of deposits with insured depository institutions for a third party.

To see the FDIC's definitions of "brokered deposit"" and "deposit broker", view C.F.R. 337.6 at the FDIC's web site.

Practically speaking, there are three kinds of deposits that may apply:

- direct certificates of deposit from investors, which may or may not be brokered deposits;

- certificates of deposit where a third party, such as Primary Financial, acts as an administrator, custodian, agent or trustee, which are generally considered brokered deposits; and

- DTC-eligible brokered deposits.

Who can accept brokered deposits?

Section 29 of the FDI Act, implemented by Part 337 of the FDIC Rules and Regulations, states that a well capitalized, insured depository institution is allowed to solicit and accept, renew or roll over any brokered deposit without restriction. An adequately capitalized , insured depository institution may accept, renew or roll over any brokered deposit once it has applied for and been granted a waiver by the FDIC. An undercapitalized insured depository institution may not accept, renew, or roll over any brokered deposit.

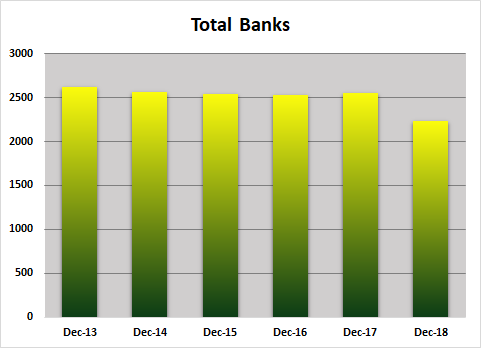

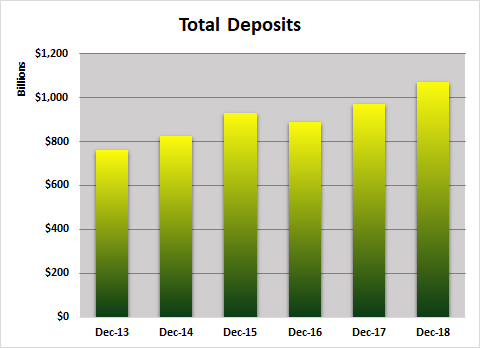

Who has been accepting brokered deposits?

The bar graphs below show brokered deposits over the last six years:

| Banks | Deposits | |

| Dec - 13 | 2,624 | $760 billion |

| Dec - 14 | 2,569 | $823 billion |

| Dec - 15 | 2,542 | $930 billion |

| Dec - 16 | 2,526 | $889 billion |

| Dec - 17 | 2,554 | $971 billion |

| Dec - 18 | 2,228 | $1.071 trillion |

* Veribanc, Inc., Federal Deposit Insurance Corporation

Why should my financial institution accept brokered deposits?

If you're responsible for generating deposits for your institution, you have a responsibility to your owners to increase your bottom line by researching all viable funding alternatives.

The good news is that if your financial institution is well capitalized, you can accept brokered deposits without limitation. In fact, the prudent use of brokered deposits within legal requirements is entirely acceptable to the FDIC. Brokered deposits should be treated and assessed as any other funding alternative, having their own special advantages and disadvantages.

Before issuing federally insured CDs through SimpliCD, Primary Financial recommends that you create a policy on accepting brokered deposits to satisfy regulators and auditors. We also recommend that your institution employ proper funds management policies, perform adequate due diligence when assessing deposit brokers and brokered deposits, and diversify its portfolio.

With a policy in place to accept rate-sensitive deposits, taking brokered deposits has several benefits:

- You have access to a larger market of investors than you do when you accept deposits only from your local market area.

- You can open deposits at rates cheaper than when you solicit rates nationally through rate services.

- You save operational costs by having one central contact instead of many.

- Accepting larger pieces saves you time and resources over multiple smaller pieces.

Where can I learn more?

For a full-text version of the FDIC: DOS Manual of Examination Policies, Liquidity and Funds Management, Section 6:1, visit http://fdic.gov/regulations/safety/manual/section6-1_toc.html.

To search the FDIC database for a bank, visit http://www2.fdic.gov/idasp/main.asp.

To search the NCUA database for a credit union, visit http://researchcu.ncua.gov/Views/FindCreditUnions.aspx.

Why should my financial institution accept brokered deposits through Primary Financial and SimpliCD?

- Since 1996, Primary Financial has placed more than $47 billion dollars in federally insured certificates of deposit.

- Our relationships with thousands of credit unions mean that we're more likely to roll certificates at maturity than other brokers. When a certificate we've placed with your institution matures, Primary Financial contacts you to negotiate a rate. As long as your rates are competitive, we work to keep the funds with your institution. Even when an investor needs their principal at maturity, we can often find another credit union looking to invest.

- Because our deposits are institutional deposits, issuing with Primary Financial raises no USA PATRIOT Act compliance issues. Our customers are U.S.-domiciled financial institutions, and we do not maintain relationships with individual persons as defined by the Act, Section 312.

- We're committed to safety and soundness. For a detailed discussion of our commitment to safe and sound operation, click here or download our latest annual report.

- Because we're member owned, all of our profits ultimately flow back to our owners. We are driven by a desire to provide high quality service at a reasonable cost. This business model passes along the savings to issuers in the form of lower interest rates.

Get Started

1-800-639-0339

1-800-639-0339

Work with our trading desk to develop the terms of issuance.

Make your offerings available to a nationwide market of investors the same day.

Log-In

Log-In